2025/04/08Views(9226)Reviews(0)

I. Target Audience

Warehouse, Operations

II. Feature Overview

The Inventory Management System - Deduction Records feature is one of the functions of the First-In, First-Out (FIFO) FBA module, used to view detailed records of product inventory deductions based on the FIFO method.

【First-In, First-Out (FIFO)】Introduction

SellerSpace GOGS by Batch, specifically for Amazon product FBA inventory, aggregates in-stock, replenishment, FBA inventory adjustments, and restockable returns inventory. It implements a deduction model where inventory that arrives first is shipped out first. This solves the issue of varying product costs due to different shipment batches and logistics fees, which are difficult to track manually. Ultimately, it helps sellers accurately calculate profits and reduce manual labor costs.

1. Deduction Batch Generation Logic:

The system generates corresponding deduction batches based on the order in which product FBA inventory enters Amazon warehouses.

Deduction batch inventory categories: 【Beginning Inventory】 and 【Shipment Replenishment】 inventory.

Taking May 6, 2022, the feature launch date, as the dividing line,

FBA inventory before May 6, 2022, because the order of inventory entering the warehouse cannot be determined, is uniformly categorized as 【Beginning Inventory】, and this batch of inventory is deducted first;

For FBA inventory after May 6, 2022, the system automatically obtains the order in which it enters Amazon warehouses and generates corresponding deduction batches, i.e., 【Shipment Replenishment】 inventory, which is deducted sequentially according to the time order.

If it is a store authorized after the feature launch, the authorization time is the dividing line,

FBA inventory before the authorization time point is uniformly categorized as 【Beginning Inventory】;

FBA shipment inventory after the authorization time point, according to the warehouse entry time order, generates corresponding deduction batches, i.e., 【Shipment Replenishment】 inventory.

2. Inventory Deduction Rules:

- Following the logic of first-in, first-out, inventory is deducted sequentially, and the corresponding product cost is applied;

- If there are product returns, they will be returned to the corresponding batch, and subsequent inventory deductions will prioritize deducting the returned inventory. For example, if there are returns for orders before May 6th, they will be returned to the beginning inventory and deducted first;

3. Product Cost Setting and Application:

- FBA inventory for which outbound delivery is processed in the SellerSpace system: the system automatically synchronizes shipping costs, including: product cost, first-leg logistics fees, and other costs, and applies the corresponding cost fees according to the allocation method set for shipping. Click to view how to ship FBA

- FBA inventory for which outbound delivery is not processed through the SellerSpace system: the cost defaults to 0, and product costs and logistics fees, etc., need to be manually set through the 【Reset Cost】 function. See the《Batch Management - Graphic Tutorial》for operation methods.

4. Inventory Deduction Type Description:

- Divided into 7 main types: Order Placement, Order Cancellation, Order Return, Seller Return, Inventory Adjustment, Shipment Adjustment, Beginning Adjustment.

- All types are synchronized Amazon deduction types, not determined by the SellerSpace system itself.

III. Use Cases

- View detailed deduction records of product inventory.

IV. Operation Guide

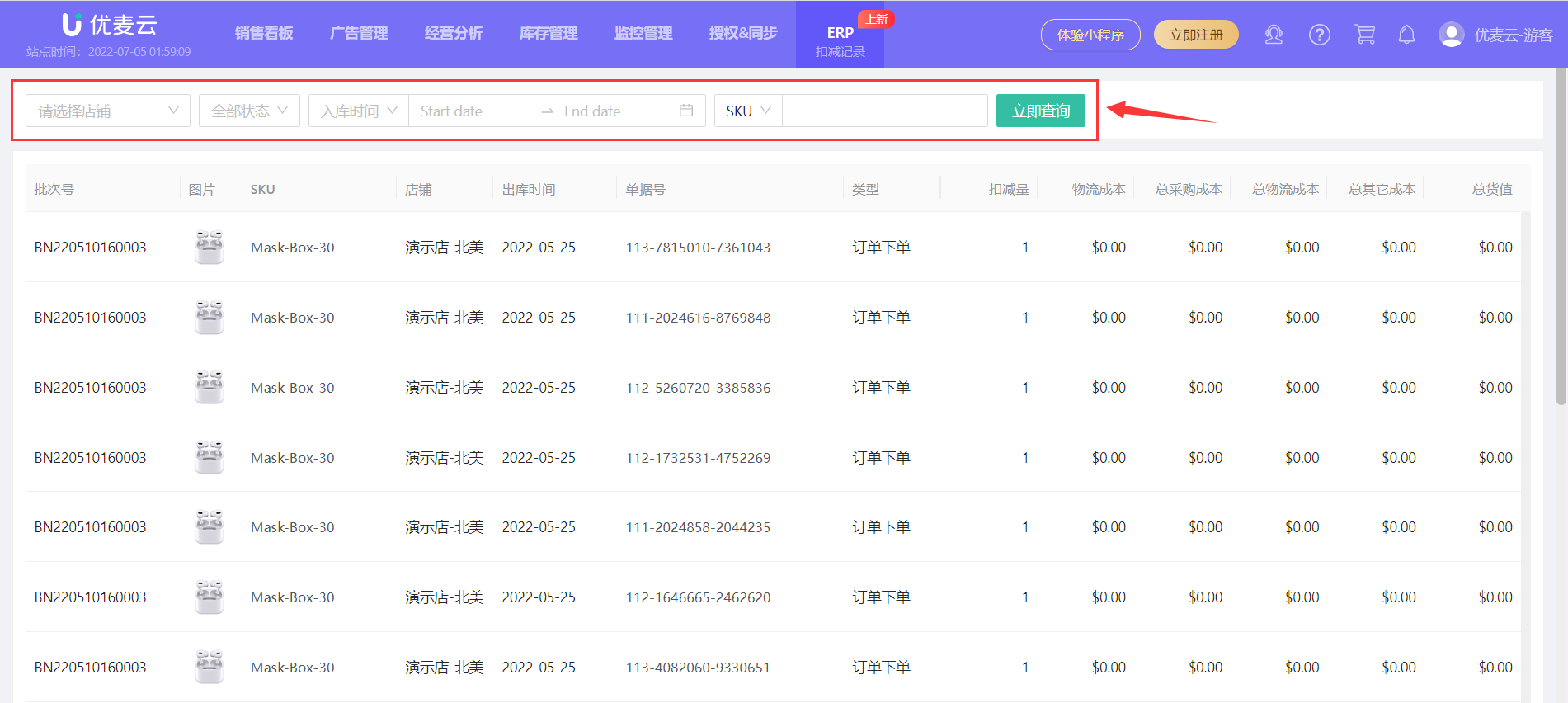

Through the filter bar, you can filter and view the batch deduction details of the corresponding products. Filter conditions include: Deduction Store, Deduction Type, Inbound Time, Batch Information.

+

+