2025/03/21Views(21860)Reviews(0)

SellerSpace accurately calculates your store's profit, with consolidated management for multiple stores.

To facilitate user review and reconciliation, we categorize profit into three types: Real-Time Sales Profit, Periodic Profit, and Financial Profit.

Among these, [Real-Time Sales Profit] and [Periodic Profit] are calculated based on the event occurrence time of sales and profit, while [Financial Profit] is calculated based on the financial event time of sales and profit.

For example, a buyer clicks on a seller's ad and places an order for the advertised product on August 30th. The order is delivered to the buyer on September 1st, and financial entries are returned.

In this scenario, in [Real-Time Sales Profit] and [Periodic Profit], the order and advertising costs will be counted in August. In [Financial Profit], the order will be counted in September. Advertising costs, if deducted in August, will be counted in August; if deducted in September, they will be counted in September.

1. Real-Time Sales Profit

Real-time sales profit refers to the profit calculated based on the actual sales data generated on the current day.

Calculation Formula: Real-Time Sales Profit = Sales Revenue - Total Expenses

Where:

Sales Revenue = Product Selling Price x Sales Quantity

That is, the sales revenue of an order is the total amount of the item price + item tax in the Amazon Seller Central transaction details for that order.

Total Expenses = Advertising Costs + FBA Fees + Commission + Promotion Fees + Item Tax VAT + Amazon Other Fees + Review Campaign Costs + Set Product Purchase Cost + Set Product Shipping Cost + Set Product Other Costs + Entered Store-Level Costs + Entered Product-Level Costs.

Real-time sales profit is used in these features: Homepage Dashboard, Instant Sales, Sales Overview, Product Analysis, Marketplace Analysis, and SellerSpace App. The profit you see in these features is Real-Time Sales Profit.

Special Notes:

① Product Dimension: Sales Dashboard (3 features) -> Order Product, Operations Analysis -> Product Analysis, SellerSpace App -> Instant Sales, only includes profit after deducting expenses related to product orders and advertising expenses, excluding costs related to refund orders;

② Marketplace Dimension: Homepage Dashboard -> Profit & Expenses/Order Marketplace Distribution, Operations Analysis -> Marketplace Analysis, SellerSpace App -> Sales Overview, Official Account Performance Push, only includes profit after deducting expenses related to product orders, advertising costs, and entered store costs, excluding costs related to refund orders.

About Cost Allocation:

① Sponsored Brands (SB) Ad Spend: Takes advertising business report data and allocates it according to the allocated products and allocation ratios configured for each SB ad.

② Store Other Costs: After enabling "Automatic Synchronization", the synchronized fees are automatically allocated to corresponding products according to manually configured ratios or based on the product's sales volume ratio/sales revenue ratio.

③ Store Other Costs include: Lightning Deal submission fee, monthly subscription fee, Vine enrollment fee, Other - service fees, shipment label purchase, Other - FBA inventory and inbound service fees, paid service fees.

How is Return and Refund Data Reflected?

Real-time sales profit does not include costs related to returns and refunds; it is considered periodic data. Because buyer returns are uncertain events and not generated in real-time. A product bought last week might be returned this week. Therefore, real-time sales profit does not include this data.

However, return and refund data may appear in some features that display real-time sales profit. In these cases, return and refund data is for display purposes only and is not included in the real-time sales profit calculation.

+

+

(Example: Homepage Dashboard)

2. Periodic Profit

Periodic profit refers to the profit calculated including periodic expenses, such as storage fees, returns and refunds, removal fees, etc.

The calculation formula is the same as Real-Time Sales Profit, but periodic expenses are added to the total expense calculation.

Periodic expenses include: Amazon Reimbursements, Returned/Replaced Product Cost Restock, Refund Amount, Monthly Storage Fees, Long-Term Storage Fees, Removal Fees

Periodic profit is only used in the [Profit Statistics] feature to facilitate viewing store profit in different dimensions. Among them, the Marketplace dimension, Store dimension, and Monthly dimension include all expenses related to product orders, advertising expenses, all Amazon reimbursement fees, storage fees, removal fees, and other store-level costs.

About Cost Allocation:

① Sponsored Brands (SB) Ad Spend: Takes advertising business report data and allocates it according to the allocated products and allocation ratios configured for each SB ad.

② Store Other Costs: After enabling automatic synchronization, the synchronized fees are automatically allocated to corresponding products according to manually configured ratios or based on the product's sales volume ratio/sales revenue ratio.

③ Store Other Costs include: Lightning Deal submission fee, monthly subscription fee, Vine enrollment fee, Other - service fees, shipment label purchase, Other - FBA inventory and inbound service fees, paid service fees.

+

+

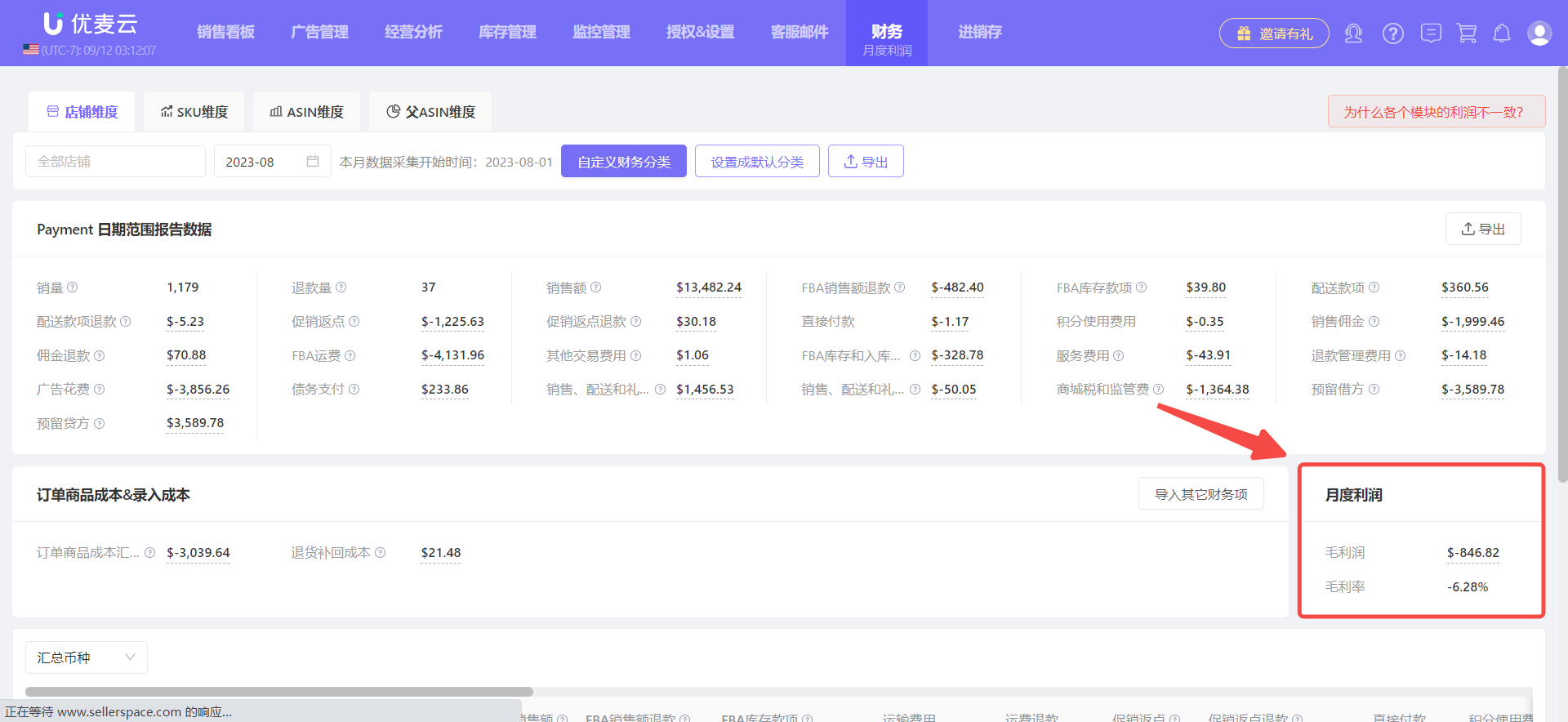

3. Financial Profit

Financial profit refers to the settlement profit in financial terms, used for financial accounting and reconciliation.

Financial profit is statistically analyzed in the Financial section, which includes 2 features: Monthly Profit + Payout Report.

Monthly Profit: Monthly profit data related to financial dimensions, including 4 dimensions of data: Store dimension, SKU dimension, ASIN dimension, and Parent ASIN dimension.

Payout Report: Store payout-related data, including detailed information for each settlement.

About Cost Allocation:

① Sponsored Brands (SB) Ad Spend: Takes advertising business report data and allocates it according to the allocated products and allocation ratios configured for each SB ad.

② Sponsored Products (SP) and Sponsored Display (SD) Ad Spend: Takes advertising invoice data, and then allocates it to corresponding products based on the proportion of advertising product spend in the advertising business report data.

③ Store Other Costs: After enabling automatic synchronization, the synchronized fees are automatically allocated to corresponding products according to manually configured ratios or based on the product's sales volume ratio/sales revenue ratio.

④ Store Other Costs include: Lightning Deal submission fee, monthly subscription fee, Vine enrollment fee, Other - service fees, shipment label purchase, Other - FBA inventory and inbound service fees, paid service fees.

+

+

Special Notes:

1. Both [Real-Time Sales Profit] and [Periodic Profit] include Pending orders. For Pending orders, the Amazon API returns 0 sales data for a period of time. Therefore, the system will budget based on the recent transaction status of the order product or the most recently synchronized product price. Budget metrics include: Sales Revenue, Item Tax, Amazon Commission, FBA Fees, Promotion Fees, etc.

When a Pending order has financial entries, if there is a discrepancy between the system's budgeted amount and the actual financial entry amount, the system will automatically update based on the financial entries.

2. For store-level other costs, it is recommended to enable the [Automatic Synchronization] feature in "Authorization & Settings -> Store Other Costs". After enabling, the system will automatically synchronize the following fees into profit statistics: Store Rent, Vine Fees, Lightning Deal Submission Fees, and other store-level fees deducted by Amazon. If not enabled, these fees need to be manually uploaded.

Important Notes:

· It is recommended to only manually upload store-level costs for time periods that are not automatically synchronized. If you upload data for automatically synchronized time periods, these fees will be double-counted in the [Monthly Profit] feature.

· After synchronizing the above fees, the system will allocate them to specific products according to your configuration or default allocation rules, making product profit more accurate.

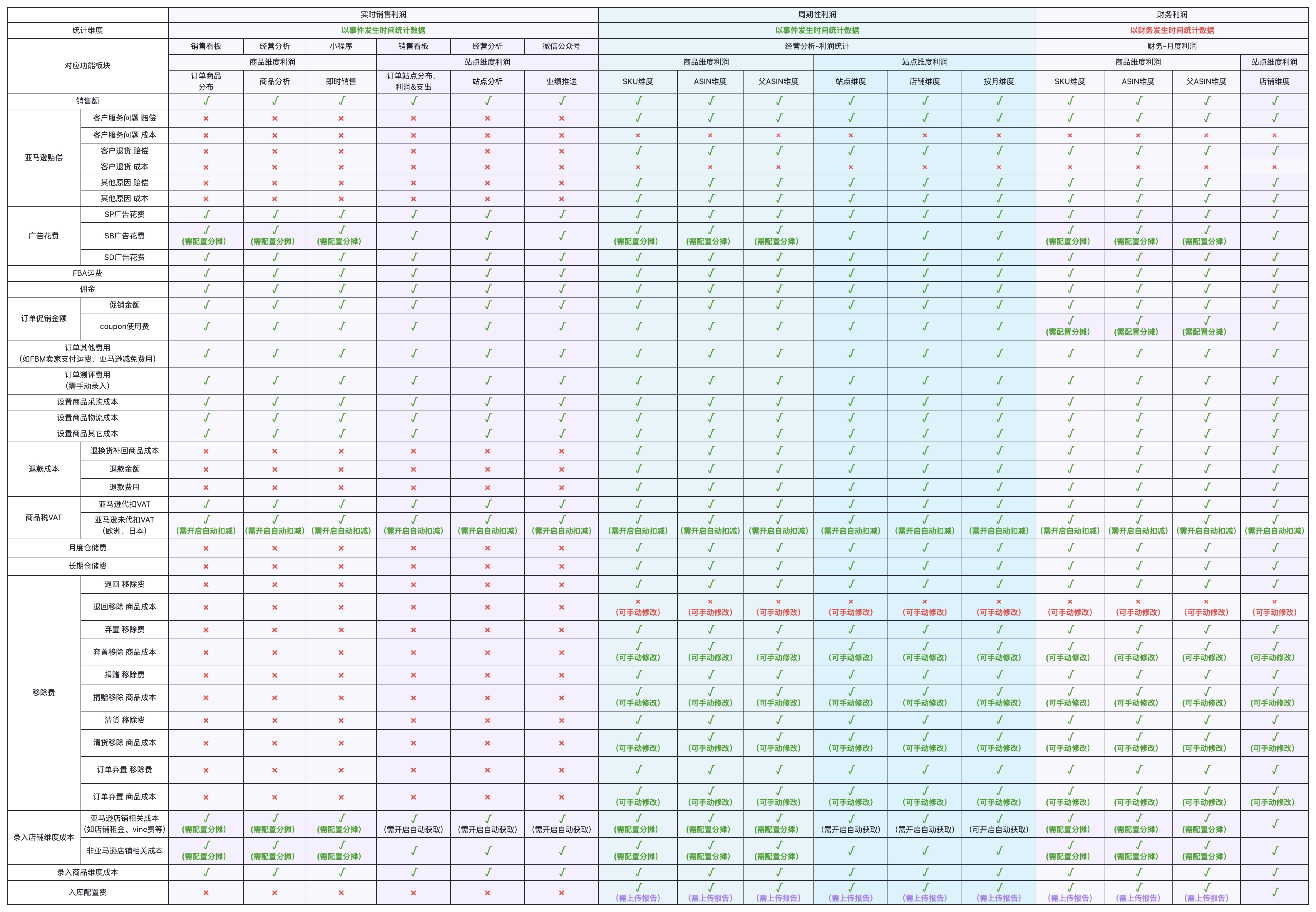

Please see the table below for details of expenses included in each profit module:

+

+